Reforms from 1 January 2019

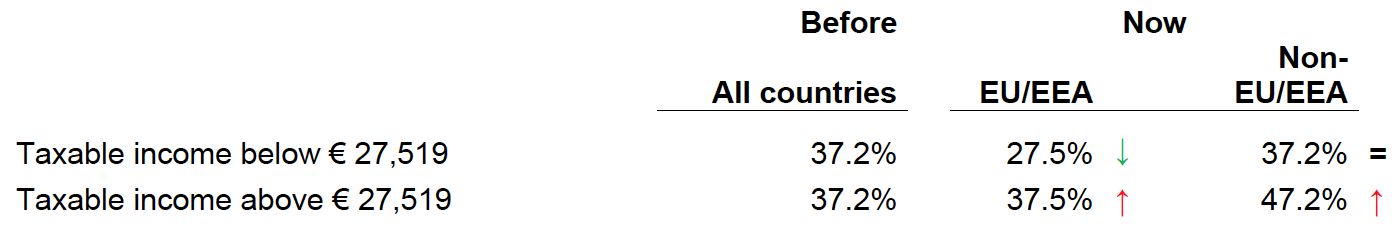

Notable changes have been made to the taxation of non-residents from 1 January 2019. The flat-rate tax will increase from 20% to 30% on taxable income exceeding € 27,519. Social contributions for nonresidents affiliated with a social security system in another EU/EEA country or Switzerland will reduce from 17.2% to 7.5%. Social contributions will be maintained at 17.2% for all other non-residents.

Summary of changes and effective tax rate (income tax and social contributions) :

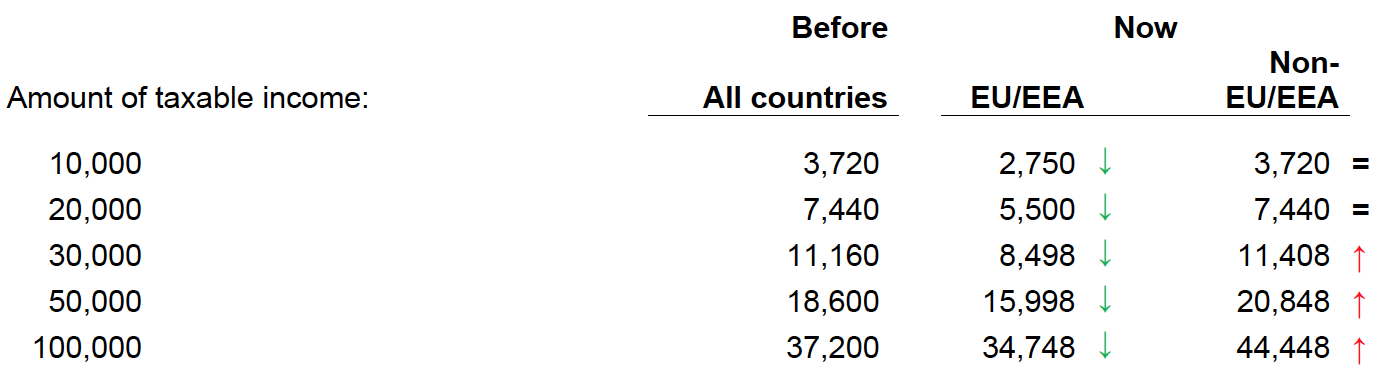

Illustration of tax payable :

Conclusion

For virtually all non-residents registered for healthcare in the EU/EEA, this will be a favourable reform (↓).

For non-EU/EEA residents with taxable income below € 27,519, it will be neutral ( =).

Non-EU/EEA residents with income exceeding € 27,519 can expect an increased tax liability. (↑).

For all non-residents, in particular those in the final category, a lower income tax rate can be applied if the tax payer can prove that their effective tax rate in France would be lower than 20% or 30% if their worldwide income were taxable in France.